Inside or outside

The first thing to consider is whether the source of the water that caused the damage was from inside the home or outside the home.

Water that begins outside the home and ends up causing damage is generally not covered. The biggest example of outside water is flooding. Floods are one of the most common and most destructive types of water damage, but homeowners policies do not cover them. You can get an additional flood insurance policy; however, and if you live in an area with frequent floods, like near the Chesapeake Bay, it is probably a good idea.

Roof leaks are an exception to the “outside the house” rule. Because your roof is a key structural element of your home, and one of its purposes is to keep rainwater out, homeowners policies will generally cover rain water damage if it entered due to a failed roof.

Water that begins inside the home, though, is covered — when other factors are taken into consideration. This kind of damage could be from an appliance (like a refrigerator or washing machine) malfunctioning or from a plumbing problem.

Gradual and negligent vs sudden and accidental

But on top of the “inside vs outside” considerations, you also have to consider whether the damage occurred because of a gradual issue (especially if it included neglect), or if it was due to a “sudden and accidental” issue.

While water damage due to plumbing problems can be covered, for example, this rule will determine whether it will be. A pipe that burst suddenly and with no negligence on the homeowners’ part is covered in most policies. However, if the heat was turned off during the winter, and that’s why the pipe burst, this could be considered neglect, leading to the claim being denied.

Also, if the plumbing issue is from a gradually worsening problem where the homeowner should have performed routine maintenance, then the water damage wouldn’t generally be covered. For that reason, clogs and backups from exit pipes are not covered.

While the two basic tests can give you a good idea of what is covered and what isn’t, specific homeowners policies can differ. So, if you really want to know the answer in your circumstance, call your insurance agent. Don’t have one? Call Winstead to learn more at (410) 398-6700. We provide not only homeowners insurance, but car insurance, business insurance, life insurance, and so much more.

A few quick tips

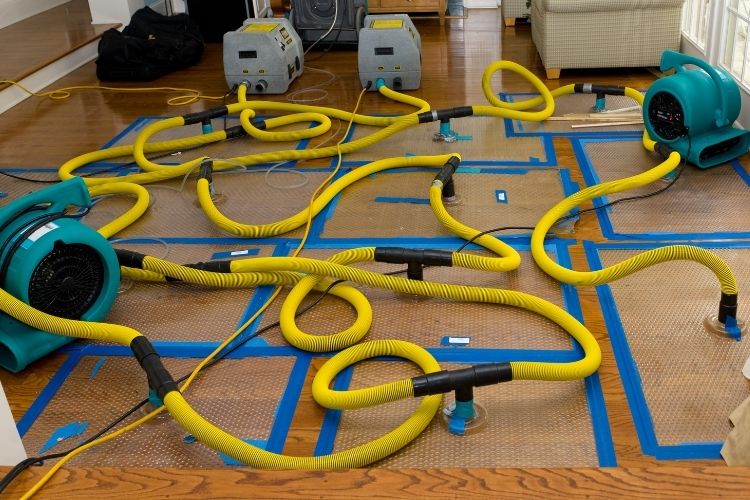

Because water damage can be so expensive — due to mold, ruined drywall and insulation, rotting wood etc — a little knowledge can go a long way. As a bonus, here are some tips that may end up saving you big money.

- If you notice some mold, act fast. A little mold is not a big deal, but a lot of mold can become a dangerous, messy and expensive problem.

- Take pictures and call your agent immediately. When you notice water damage, the right time to act is at that moment. Delaying can lead to a claim being denied for a number of reasons.

- Know where your main water shutoff is. If a pipe bursts, water will come pouring out, and every second counts. But if you know where the shutoff valve for the whole house is, you can quickly stop the flow. If you don’t, you may have to wait an hour or more for someone to come find it for you. The damage at that point will be astronomically worse.

- Repair roof damage. If a storm damages your roof, get it fixed. Ignoring it may mean the insurance company won’t fix the roof or the water damage when the next big storm hits.

Recent Comments